There are no impending weather events at this time.

FMIT Alert:

Hurricane Irma Recovery Update

3+ Weeks from Landfall

-

Members who have not reported damages or had Damage Assessments performed, should report any and all damages to Member-owned property caused by Irma to FMIT as soon as possible.

-

The period for receiving a complimentary Damage Assessment of known damages to your insured assets is coming to an end. The purpose of these assessments is to document the post-loss condition of damaged assets. While not a formal adjustment, these assessments streamline the assigning of an adjuster and are used for reporting damages to insurance and documenting for potential Public Assistance purposes. Email irma@flcities.com to request a Damage Assessment along with a list of damaged locations/assets for us to review.

-

Alternatively, you can email irma@flcities.com directly with your claim information related to damaged covered property and covered vehicles. Please note the Damage Assessment method is the most effective and efficient method of claim reporting since it syncs with FMIT’s claims system. Either way your claim-related communications will be addressed as quickly as possible.

-

Adjusters have been visiting Member locations this week as FMIT is currently deploying a state-wide rollout of insurance adjusters.

-

Adjustment teams should be contacting you to schedule your site visits over the coming days.

-

Adjustment teams are focused on visiting losses to buildings and larger structures. Some of these may be at secure facilities, such as water plants. Please ensure the appropriate personnel are available when scheduling site visits..

-

Irma caused widespread minor damages to many scheduled buildings and structures. With the application of the Named Storm Deductible (NSD) as standard part of municipal insurance programs in Florida, for this event deductibles change from the per occurrence P&C deductible (found on the Declarations Page) to the Named Storm Deductible, which is calculated using a percentage (typically 2%, 3%, or 5%) that is multiplied by the scheduled value of each building/structure. In effect, each scheduled asset will have its own deductible.

-

Due to the application of the NSD for wind-related damages, unfortunately many covered member damages to scheduled buildings and structures will fall below the deductible threshold for receiving insurance proceeds.

-

Members will need to manage the recovery of the below-deductible losses assets directly as they would not be eligible for FMIT Turnkey Recovery program unless the Member has a contract with SynergyNDS, Inc. to perform recovery of assets below deductible. This is to protect FMIT Members from potential issues with FEMA public assistance when using a Recovery Program Manager for under-deductible losses.

-

We know that many Members have also experienced damage to Property in the Open (PITO), such as fencing, lighting, playground equipment, etc.

-

Covered PITO is addressed in a special endorsement in the 2016-17 policy. Covered PITO must not be excluded in the PITO Endorsement and must be located at a scheduled location in the policy.

-

Damages to PITO covered under the Endorsement are subject to a PITO sublimit (found on the Dec Page of the FMIT Policy) with a minimum limit of $100,000 per Member).

-

The named storm deductible for PITO is triggered when damage amounts to all covered real property (building, structures, property in the open) exceed the Member’s P&C Deductible for Real Property (found on the Dec Page of the FMIT Policy). Once triggered, the PITO deductible is calculated by multiplying the Named Storm Deductible Percentage in your Named Storm Deductible Endorsement (typically 2% ,3% or 5%) by the actual recovery cost of the covered PITO damages.

-

Example: Member P&C Deductible is $25,000 and NSD is 3%

-

Assume: Damage to scheduled buildings/structures > $25,000

-

Assume: Covered PITO damages of $50,000

-

PITO Deductible: 3% multiplied by $50,000 = $1,500

-

FMIT Anticipated Proceeds: $50,000 – $1,500 = $48,500 (97%)

-

While most PITO is included in the Endorsement, the following assets are not covered and would need to be scheduled separately in the Real & Personal property schedule in order to receive coverage:

-

Signs & Scoreboards (excl. signs attached to buildings)

-

Pavilions & Shade Structures

-

Non-Fixed Assets (portable shade structures, trash cans, etc.)

-

Pumps

-

Please review the PITO Endorsement for more information

-

When repairing covered PITO damages, ensure that you are documenting a photo of the damages and keeping track of all costs incurred by your organization (overtime hours for salaried staff, hourly rates paid to subs, invoices for repairs, etc…) as these will need to be submitted to FMIT for reimbursement.

-

While much of the damage caused by Irma is covered under the FMIT policy, most of Irma’s damage to Member buildings and larger structures will fall well below the Named Storm Deductibles triggered when Irma made landfall as a named storm in Florida.

-

Members can apply for reimbursement for repairs to these damages by applying for federal public assistance through the Federal Emergency Management Agency (FEMA).

-

Members need to ensure that they are following their internal procurement procedures for making repairs to damages assets. If Members’ internal procurement procedures prior to Irma include expedited processes for critical assets damaged due to catastrophic events, those will likely be respected by FEMA.

-

The first step in applying for FEMA Public Assistance is to go to www.floridapa.org and apply. Follow the instructions and fill out the information in order to register in the system.

-

FEMA has a site that answers commonly asked questions located at: https://www.fema.gov/public-assistance-frequently-asked-questions

-

FEMA is currently busy responding to 3 major disasters (Harvey-TX, Irma-FL, Maria-PR). FMIT anticipates that this will somewhat delay the process. Once Members begin scheduling their Kick-Off meetings, they should notify FMIT using the propclaim@flcities.com email.

-

Many Members are facing issues related to debris removal. In nearly all cases, debris from trees or any vegetation knocked over or damaged by the storm is not covered under the FMIT Property Policy unless the debris is either:

a) contacting an insured asset, or

b) blocking immediate access to an insured asset & impeding recovery. -

Any Members that have or are seeking a debris management contractor should ensure that your agreements with said contractor include verbiage that indemnifies and remunerates your organization specifically from errors made by the contractor during the debris management process that would disqualify your organization from FEMA Public Assistance. We also strongly suggest you consult with your organization’s attorney prior to any procurement to assure compliance with any existing or emergency orders or directives applicable to debris removal, FEMA funding or the like.

-

We have been getting requests regarding Member trees that have fallen on citizens’ homes/property. In these cases, FLC will have to determine if the tree was dead or otherwise in a poor condition before rendering a coverage decision. In most cases this is an “act of God” that would not be the fault of the FMIT Member. It is the homeowner’s responsibility to remove the fallen trees on their property and to mitigate additional damages. Homeowners can be advised to file a claim with their homeowner’s insurance company.

-

This is a very popular question among FMIT Members. Through the FMIT PACT (Public Assistance Closeout Team), we have worked with FEMA and Members on previous de-obligations from ‘04/’05 storms as well as recent Hurricanes Hermine and Matthew. We will be supporting Member FEMA PA Applications and associated project worksheet development, where requested, in order to minimize potential issues. We will work with the FEMA PAC specialist to review the project worksheet to ensure that there is no potential duplication of benefits and that the claim has been adjudicated correctly. Information is already being captured in simpliCity under each Member’s claim to assist in the documentation process.

-

Please Ensure That Recovery Operations Are Undertaken Safely. Click Here to download an Overview of Post Event Safety.

FMIT Alert Level 2:

Low-Moderate

Invest 99L Currently Over Florida Keys; Formation Into a Major Storm Not Expected, However Will Bring Potentially Heavy Rains and Gusty Winds Over the Weekend.

FMIT Member:

Friday September 29, 2017

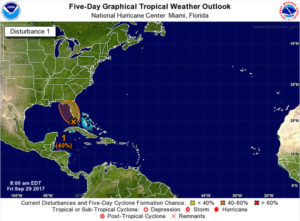

Latest from the National Hurricane Center:

“A broad surface trough interacting with an upper-level low is

producing a large disorganized area of clouds and showers from

the NW Caribbean across Cuba to southern Florida. A weak low is

expected to form from this system near SW Florida this weekend.

Environmental conditions appear conducive for some development

of the low during the next 2-3 days. This system has a moderate

chance for tropical cyclone development in the next 48 hours.”

(Courtesy http://www.nhc.noaa.gov/ and http://www.wunderground.com/)

FMIT Discussion:

-

Invest 99L is currently over the Florida Keys and projected to continue to move north.

-

The National Hurricane Center currently gives Invest 99L a medium chance of tropical depression formation over the next 2 days.

-

From Sunday onwards, conditions will become less conducive for development.

-

At this time we do not expect formation into a major storm, but the system will bring potentially heavy rains and gusty winds over the weekend.

-

Areas of Florida could receive anywhere from 1″-5″ of rain through Sunday with locally higher amounts possible.

-

FMIT will continue to monitor Invest 99L and provide additional alerts should projections change drastically over the next 24-48 hours.

FMIT Member Preparedness Actions:

-

Members should continue to monitor Invest 99L as well as FMIT Alerts and local/national weather forecasts.

-

Members with previous Irma damage should ensure that they are mitigating potential additional damages to affected buildings/structures by tarping, bracing or otherwise securing damaged assets.

-

If you need assistance mitigating previous damage from Irma to covered assets, please email, irma@flcities.com to request mitigation procedures through FMIT.

CAT 3

Current Atlantic Tracking Map

Fact Sheet

Installation & User Guide

of Building Safety Inspections

Supporting Emergency Work

FMIT ALERT RATING SYSTEM

FMIT ALERT

RATING SYSTEM

In order to give Members a clearer decision path for responding to alerts, FMIT will begin using a new alert rating system. The rating system will be based upon a combination of data that takes into account the following factors with regard to a weather event: Current NOAA Data, Relative Proximity to Florida and Predicted Path & Intensification Data from various sources. We will use a 5-number rating system in ascending order of intensity (similar to how hurricane intensity is rated) in order to help you determine how you should respond to alert information. The numbering system will work as follows:

Click on the Following FEMA Public Assistance FACT SHEETS Along With Other Materials for Additional Information to Support Your Response & Recovery Initiatives:

Damage Reporting Options:

-

Call 844-FMIT-CAT (844-364-8228) to report any losses to your insured property and activate the FMIT Turnkey Recovery program for immediate response to any property losses you may have incurred. Also:

-

Go online: http://insurance.flcities.com and login to your account and submit your loss notice(s). FMIT and Synergy are immediately notified of your loss submittal.

-

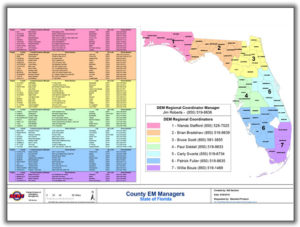

County Emergency Managers List – For additional contact information about your county, please Click Here.